Uncategorized

When investigating solar power systems for your business, it is important to assess all the finance options available to you. The route you take finance-wise depends on your business’s cash flow, budget and projections. Let’s explore some of the solar power finance options available to your business.

Upfront Payment

If your business has the capital and good cash flow, you could afford to pay the costs of installation upfront. Paying the full amount for your new solar power system upfront has the benefit of helping you avoid paying any interest and potentially enjoying the cost-saving benefits sooner. Sometimes when paying the full amount upfront, you are able to negotiate a discount with the installer.

Business Loan

If your business is not in a position to fork out the upfront investment on a solar power system, you can look into applying for an unsecured business loan to fund the project. If your business has made more than R1 million in turnover in the past year and has been trading for over 12 months, you can apply for an unsecured business loan of between R50k and R3 million.

Solar Power System Rental

Another innovative finance solution is the rent to own model or solar power system rental model of finance. You will apply for solar power installation and pay a monthly rental to the installer for your solar power system for an agreed period of time. You can enjoy the cost-saving benefits of solar power from day 1 without a massive initial investment.

Interested in applying for solar power system rental? Fill out our application form and our installer will be in contact with you with the next steps.

Uncategorized

Have you been looking into investing in a solar power system for your business? You may be wondering what financing options are available to you. With the tough economic climate and exorbitant energy prices, many businesses simply cannot afford the hefty lump sum payment that comes with installing a commercial solar power system. Did you know that solar roof rental is an option for most businesses? If your business has a roof, then solar site leasing is a viable option for you.

What is solar site leasing?

Essentially, solar site leasing is renting out unused space such as your roof, parking lot or unused property into an income-generating area by agreeing to lease the property to solar power installers.

How does solar power roof rental work?

With the energy sector in disarray, the demand for renewable energy continues to grow. There is a huge demand for roof space for solar power system installation. If your business has unutilized roof space, a solar power developer will pay you an annual rental to use your roof space to generate solar power.

The solar developer takes on all the maintenance and installation costs, so there is no pressure on you in terms of financing, maintenance and running costs.

Benefits of solar power system rental

- No equipment or maintenance costs

- Funded by a third-party solar power investor/developer

- Owner of the solar power system will pay a set rental to the property owner annually

- Agreements are approximately 20 years long, guaranteeing passive income for decades

- You get a solar power system without an upfront payment

If you would like to learn more about renting your roof to a solar developer or want an idea of how much you could earn monthly, fill in our application form and we’ll be in touch with an estimate.

Personal Finance

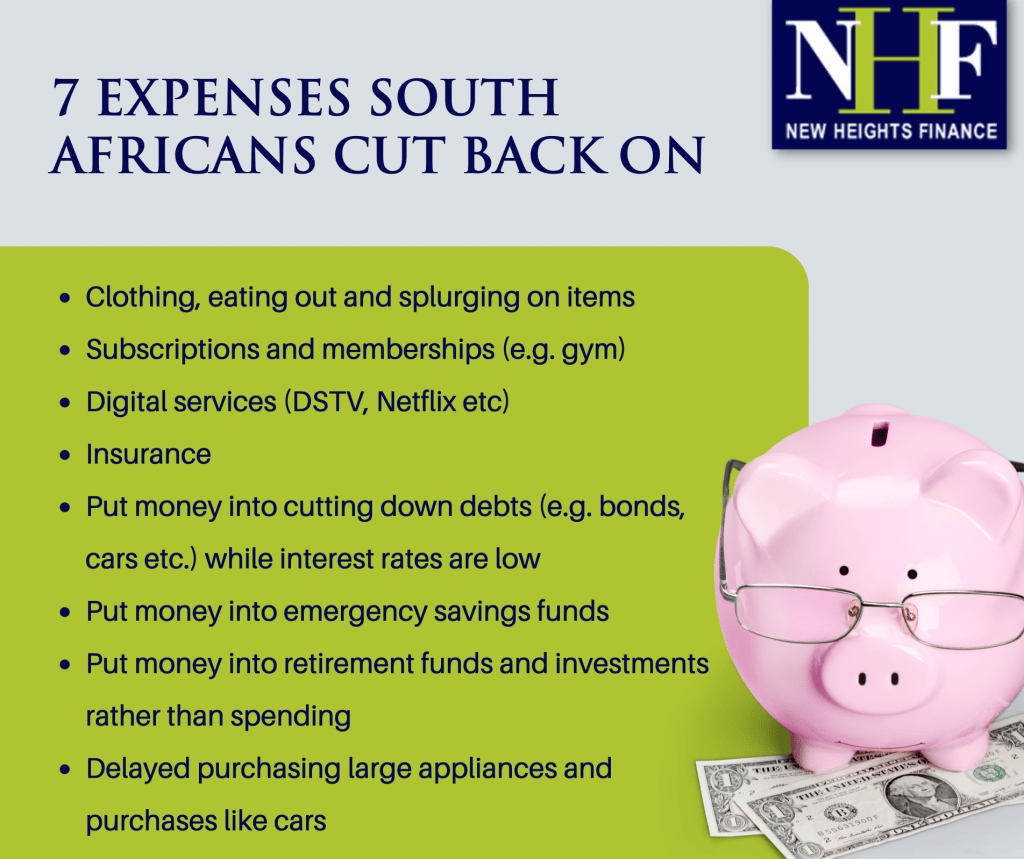

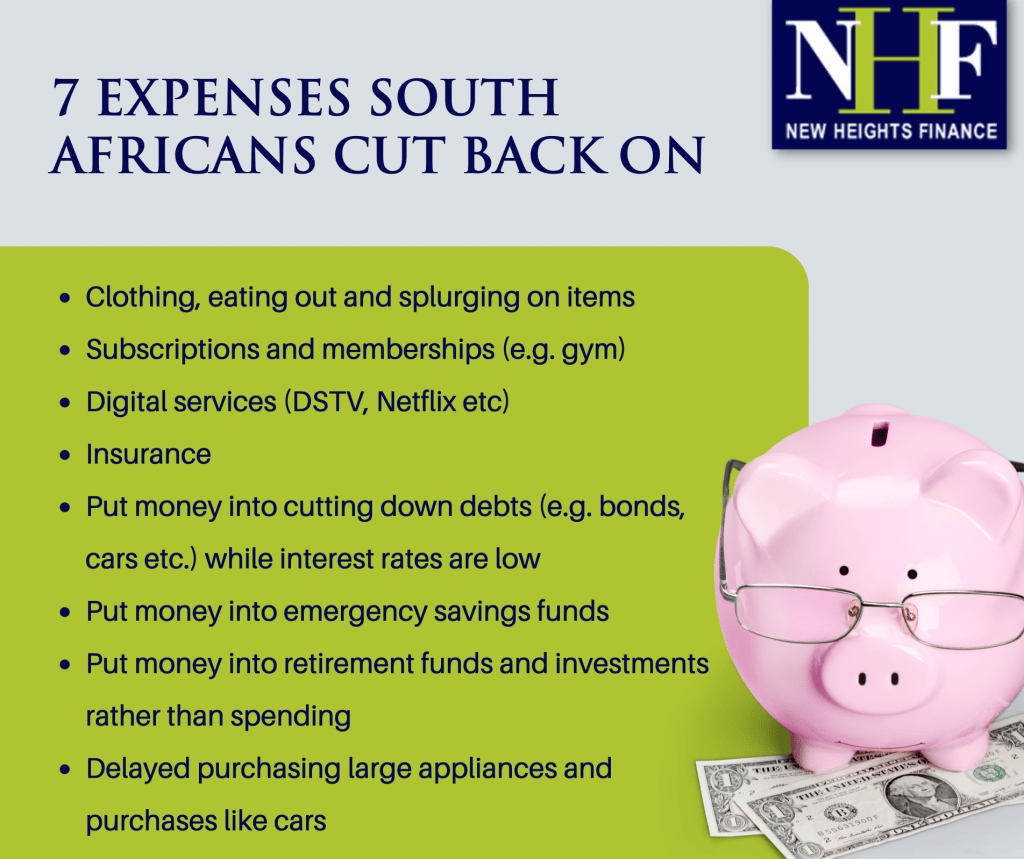

South Africans have always experienced tougher economic conditions than other countries so its no wonder we are savvy when it comes to saving money. With economic conditions being tougher than ever before, many South Africans are cutting back on their expenses in order to save money and make it through the month. In fact, 55% of all households are still bearing the brunt of the strain the Cover-19 pandemic have put on their finances.

Here is a list of the top expenses South Africans cut back on in 2023:

Most consumers have cut back on luxury and big-ticket purchases like appliances, cars and luxury brands, delaying the purchases until their personal finances recover. They have also cut back on subscriptions and memberships like gym and mobile phone contracts.

On the flip side, households have put more money into emergency savings funds, into cutting down debt and into retirement funds. 85% of households are very concerned about how they will manage to pay their bills and debts going forward if things don’t improve.

If you find yourself in a real financial bind and need access to cash quickly, apply for one of our loan solutions today:

Personal Loans – got a clear credit record and need up to R150k fast? Apply for a personal loan.

Pension Bridging Loans – waiting for your pension or provident payout? Apply for a pension cash advance and get some of your money early to ease financial stress.

Loans Against Assets – use art, jewellery, handbags and luxury items as security for a secured personal loan. Get them back once your loan is paid up.

Loans Using Un-bonded Property – is your property valued at over R2 million and fully paid up? Use your home as security for an equity release loan of R1 million or more.

Business Loans

We all know how the old saying goes…when it comes to running a business, cash is king. Steady cash flow ensures your business can cover it’s overheads while continuing to grow. However, many businesses hit a snag when there’s a lag between forking out cash for overheads and receiving money in from customers. This can limit your ability to expand your business.

There are a number of ways to manage cash flow issues and ensure a steady stream of cash entering your business at all times.

1. Cash flow projections

Every business should put together cash flow projections as part of their annual budget. If your business is seasonal and has a few months where there tends to be a lull in business, cash flow projections can help you prepare and plan for dry spells.

2. Get paid sooner

Sometimes the issue is not a lack of sales but payment terms or customers who try stall paying. There are some simple ways you can try get paid faster which include:

- Early settlement discounts (e.g. 5% off when settling in 7 days)

- Take deposits at order placement if lead times are longer

- If customers don’t pay cash up-front, run a credit check before taking them on as a client.

- Put old stock on sale to try get rid of redundant inventory

- Send out invoices promptly and send frequent reminders

- Charge interest on late payments, ensure this clause is in your T’s and C’s.

- If the same customers tend to always pay late, change your terms to cash on delivery for any future dealings with them.

3. Get Smart About Overheads

It’s important to try and get most of your money in BEFORE your expenses are due to be paid out. If suppliers offer 30 day terms, don’t pay on day 15…pay on day 30 once you know most of your income will have hit your account.

If you can, pay your bills using a company credit card. Many offer up to 55 days interest-free which means you’re up to date with your suppliers and you’re not stretched financially. It’s important to stay in their good books. If you ever foresee payment having to be made late, let them know well in advance so they too can manage their cash flow.

4. Unsecured Business Loans

Sometimes even with fine-tuned cash flow projections, chasing payments and carefully managing overheads, businesses still run into cash flow issues. Nobody predicted the Covid-19 pandemic while budgeting last year, for example and despite their best efforts, many business owners find themselves in need of cash, NOW!

The quickest way to get business bridging finance is through an unsecured business loan. You can get access to a cash loan of between R50 000 up to R5 million in as quickly as 1 business day! There’s no easier way to get cash back into your business than by applying for an unsecured business loan with NHFinance. With flexible loan terms and fair interest rates, you can get the cash you need to pay your overheads fast!

5. Direct Debits

Subscription-based businesses or businesses that collect recurring payments often struggle to find ways to collect their payments effectively. One cannot rely on customers making manual payments as they try to skip payments or simply forget to do the EFT. This makes it very hard to manage your cash flow and grow your business as you never know what you’re going to be getting in. It doesn’t have to be this way, however. Businesses accepting recurring payments can sign up for direct debits to automate the process of collecting payments from customers on a set day every month. This eliminates the hassle for the customer and makes your income far more predictable. This solution is perfect for:

- Web hosting providers

- IT services

- Short-term finance companies

- Telecommunications companies

- Gyms

- Subscription-based businesses

- Etc

Business Loans, Personal Loans

With the cost of living in South Africa on the increase, our monthly salary can sometimes barely cover our expenses, never mind during a pandemic where salary cuts and retrenchments are plentiful. From groceries to medical aid, school fees and fuel, expenses add up fast and cash dries up even faster.

If you need cash urgentlyto pay important expenses like electricity, water and rent for example, where do you get it from? Most of us think, I’ll take out a personal loan, so I can get cash today. But the reality is, banks can take weeks or months to get a loan approved. And by then, it’s too late.

And after all that waiting, they could reject your loan applicationbecause you have a bad credit score or no credit history at all. You may think there is no hope to get a loan, but we will show you how to get a loan with no credit check!

Loan Against Movable Assets

If you’ve got valuable jewellery, art, vehicles, boats or other loose assets as security for a loan, you can apply and have cash in your hand in less than 24 hours! We offer a loan product that guarantees you a quick cash loanwhen you lodge your valuables with the lender as loan collateral.

The loan term is very flexible and generally clients choose to pay back the loanover 3 to 6 months, but the loan term can be shorter or longer. This is a very quick way to get a loanwith no risk to you. Your valuables are safely stored away and returned to you in the same condition as soon as your loan is paid up. For more information or to apply for a loan against assets, click here.

For more information on personal loans, property loansor business loans, please take a look around our website. We invite you to apply for any of our loan products should you meet each product’s minimum requirements.