South Africans have always experienced tougher economic conditions than other countries so its no wonder we are savvy when it comes to saving money. With economic conditions being tougher than ever before, many South Africans are cutting back on their expenses in order to save money and make it through the month. In fact, 55% of all households are still bearing the brunt of the strain the Cover-19 pandemic have put on their finances.

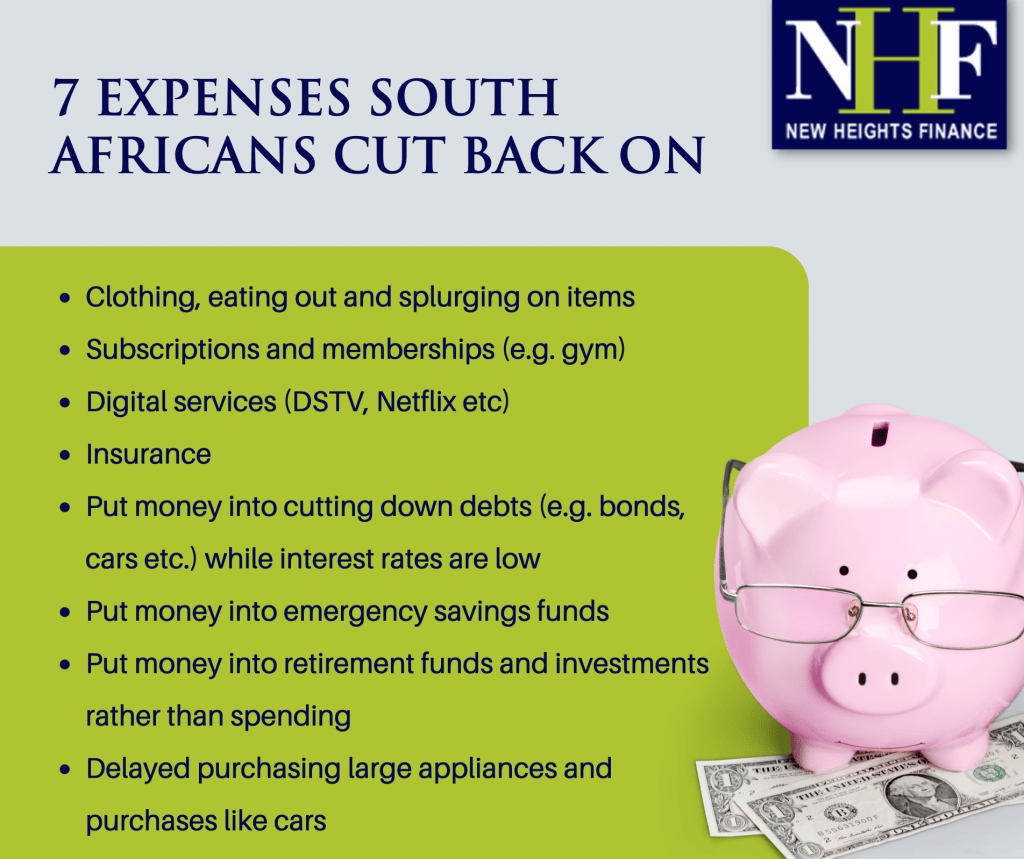

Here is a list of the top expenses South Africans cut back on in 2023:

Most consumers have cut back on luxury and big-ticket purchases like appliances, cars and luxury brands, delaying the purchases until their personal finances recover. They have also cut back on subscriptions and memberships like gym and mobile phone contracts.

On the flip side, households have put more money into emergency savings funds, into cutting down debt and into retirement funds. 85% of households are very concerned about how they will manage to pay their bills and debts going forward if things don’t improve.

If you find yourself in a real financial bind and need access to cash quickly, apply for one of our loan solutions today:

Personal Loans – got a clear credit record and need up to R150k fast? Apply for a personal loan.

Pension Bridging Loans – waiting for your pension or provident payout? Apply for a pension cash advance and get some of your money early to ease financial stress.

Loans Against Assets – use art, jewellery, handbags and luxury items as security for a secured personal loan. Get them back once your loan is paid up.

Loans Using Un-bonded Property – is your property valued at over R2 million and fully paid up? Use your home as security for an equity release loan of R1 million or more.