Business Loans

The January Cash Flow Chasm: How to Keep Your SME Moving in 2026

It’s January 2026. The festive lights are down, the offices are reopening, and the New Year’s resolutions are in full swing. But for many South African B2B businesses, January brings a cold reality: The January Cash Flow Chasm.

On paper, your December sales were fantastic. You moved record volumes of stock or delivered massive year-end projects. But because you trade on 30, 60, or even 90-day terms, that money is currently “locked” in your accounts receivable. It isn’t due to hit your bank account until late January, February, or even March.

Meanwhile, your 2026 expenses are calling. You have January rent, full payroll (after the expense of December bonuses), and suppliers who want payment before they release stock for your first Q1 orders. You are “rich” in potential but “poor” in liquidity.

At New Heights Finance, we see this every year. This isn’t a sign of a failing business; it’s a symptom of a growing one. To bridge this gap, you don’t need to take on long-term debt. You just need to unlock the money you’ve already earned through Invoice Discounting.

Why January is the Most Dangerous Month for Cash Flow

The “Chasm” happens because of a perfect storm of timing issues:

-

The Delayed Collection Lag: Big corporates and retailers often have “payment runs” that don’t resume fully until mid-January. If you missed their December cutoff, you’re in for a long wait.

-

The “Back-to-Business” Surge: To start 2026 strong, you need to buy new raw materials or stock. Suppliers, feeling their own January pinch, are less likely to extend your credit terms right now.

-

Mandatory Fixed Costs: Rent, utilities, and salaries don’t care that your biggest client is taking 60 days to pay.

The Solution: Invoice Discounting as Your 2026 Engine

Invoice Discounting is a powerful financial tool that lets you access the cash value of your outstanding invoices almost immediately.

How it works for your 2026 kickoff:

-

Step 1: You issue an invoice to your creditworthy B2B client for work done in December or early January.

-

Step 2: You submit that invoice to a funder via New Heights Finance.

-

Step 3: The funder advances you up to 85% of the invoice value (usually within 24–48 hours).

-

Step 4: You use that cash to pay your January overheads and secure new stock for 2026.

-

Step 5: When your client pays the invoice at the end of their 60-day term, the funder takes their advance plus a small fee, and the remaining 15% is paid to you.

Why This is Smarter Than a Standard Loan

-

No Property Required: Unlike many bank loans, this is secured by your invoices, not your personal property or home.

-

Scalability: As your sales grow in 2026, your available cash grows too. The more you invoice, the more you can discount.

-

Confidentiality: Most of our facilities are confidential. Your clients don’t need to know you are using a third party; you maintain your professional relationship and your own collections process.

-

Speed: Getting a new business loan in January can take weeks of committee meetings. Invoice discounting is built for the speed of modern retail and manufacturing.

Don’t let a temporary cash gap stop your 2026 momentum before it even starts. Secure your liquidity now and focus on winning new contracts, not chasing old ones.

Contact New Heights Finance today to bridge the January Chasm and keep your cash flowing.

Frequently Asked Questions: Invoice Discounting in 2026

1. Is my business too small for invoice discounting?

While some big banks only look at massive corporations, our network includes specialist funders who work with SMEs. Generally, if you are a B2B business with a turnover of R250k+ per month and have creditworthy clients, you are a strong candidate.

2. Does this work for once-off projects?

Yes! While many businesses set up an ongoing facility, “selective invoice discounting” allows you to choose specific, high-value invoices to fund when you need a specific boost—like during the January slump.

3. What happens if my customer doesn’t pay?

There are two types of facilities: “Recourse” and “Non-Recourse.” In a recourse facility, if your customer doesn’t pay, you are responsible for the funds. In a non-recourse facility, the funder takes on the credit risk (usually at a slightly higher fee). We can help you choose the right one for your risk appetite.

4. How much does it cost?

The fee is usually a small percentage of the invoice value. In most cases, the cost of the facility is significantly less than the 5%–10% discount you might offer a client for “early payment”—and it’s much more reliable.

Business Loans, Personal Finance

For business owners and individuals with a high turnover, managing assets and planning for the future is a top priority. Whether you’re appointing an executor to manage your estate, or a curator to look after the affairs of a loved one, you need to know that the assets you’ve worked so hard to build are protected. This is where a bond of security comes in. It’s a financial safety net designed to protect against financial loss due to misconduct or negligence.

In this comprehensive guide, we’ll delve into the meaning of bonds of security, how they work, the different types available in South Africa, and why they are so crucial for your financial peace of mind.

What is a Bond of Security?

A bond of security, in essence, is a type of surety bond that guarantees the performance of an individual who has been appointed to a position of trust. This individual, known as the principal, is responsible for managing the assets of another person or entity. The bond provides a financial guarantee to the obligee (in most cases, the Master of the High Court in South Africa) that the principal will perform their duties honestly and in accordance with the law.

Think of it like this: a bond of security is similar to having a co-signer on a loan. The surety (usually an insurance company or financial institution) is the co-signer, guaranteeing that if the principal fails in their duties, the surety will step in to cover any financial losses.

There are three key parties involved in a bond of security:

- The Principal: The individual or entity appointed to a position of trust, such as an executor, curator, or trustee.

- The Obligee: The person or entity to whom the guarantee is made. In South Africa, this is typically the Master of the High Court.

- The Surety: The insurance company or financial institution that provides the bond and guarantees the performance of the principal.

How do Bonds of Security Work? The Process Explained

The process of obtaining a bond of security is straightforward and typically involves the following steps:

- The Need is Identified: The Master of the High Court will determine if a bond of security is required for a particular appointment.

- Application: The principal applies for the bond from a financial institution that offers this type of service.

- Risk Assessment: The surety will assess the risk involved in the appointment. This may involve a review of the principal’s financial history and experience.

- Issuing the Bond: If the application is approved, the surety will issue the bond of security.

- Lodging the Bond: The bond is then lodged with the Master of the High Court as proof of the financial guarantee.

- Premium Payment: A premium is paid for the bond, which is usually a percentage of the value of the assets being managed. This premium is typically considered an administration expense and is paid from the estate or assets under management.

Types of Bonds of Security in South Africa

In South Africa, there are several types of bonds of security, each designed for a specific purpose. Here are some of the most common types:

Executor Bonds

When a person passes away, their estate must be administered and distributed according to their will or the laws of intestacy. The person appointed to carry out this duty is called an executor. An executor bond is a bond of security that guarantees the executor will perform their duties honestly and diligently, protecting the interests of the beneficiaries. For more detailed information on this, you can read about Executor Bonds and Bonds of Security.

Curator Bonds

A curator bond is required when a person is appointed to manage the financial affairs of someone who is unable to do so themselves, due to mental or physical incapacity. This ensures that the curator acts in the best interests of the individual and does not mismanage their assets.

Trustee Bonds

A trustee bond is a bond of security that is required for a person who is appointed as a trustee of a trust. This bond guarantees that the trustee will manage the trust’s assets in accordance with the trust deed and for the benefit of the beneficiaries.

Liquidation Bonds

When a company or individual is declared insolvent, a liquidator or trustee is appointed to manage the process of selling the assets and distributing the proceeds to the creditors. A liquidation bond ensures that the liquidator or trustee carries out their duties fairly and transparently.

Tutor Bonds

A tutor bond is required when a person is appointed to manage the financial affairs of a minor. This bond protects the minor’s assets until they come of age.

Bonds of Security vs. Insurance: Understanding the Key Differences

It’s a common misconception that a bond of security is the same as an insurance policy. While both provide a form of financial protection, they are fundamentally different.

Why are Bonds of Security Crucial for Business Owners and High-Turnover Individuals?

For those who have built up significant assets, protecting that wealth is paramount. Bonds of security offer a number of important benefits:

- Ensuring Fiduciary Accountability: They hold the appointed person accountable for their actions, ensuring they act with honesty and integrity.

- Mitigating the Risk of Financial Mismanagement: They provide a financial safety net in the event of negligence or fraud.

- Providing Peace of Mind: Knowing that a bond of security is in place can provide peace of mind to all parties involved.

- Satisfying Legal Requirements: In many cases, a bond of security is a legal requirement for certain appointments.

The Cost of Security: What to Expect

The cost of a bond of security, known as the premium, is calculated as a percentage of the total value of the assets being managed. In South Africa, the typical premiums are as follows:

- Executor Bonds: 0.5% of the asset value

- Curator Bonds: 0.6% of the asset value

- Trustee Bonds: 0.6% of the asset value

- Liquidation Bonds: 0.5% of the asset value

- Tutor Bonds: 0.6% of the asset value

It’s important to note that this premium is a legitimate expense of the estate or assets under management and is not paid out of the principal’s own pocket.

Your Path to Financial Security

Bonds of security are a vital tool for protecting assets and ensuring that individuals appointed to positions of trust perform their duties with the utmost care and integrity. For business owners and high-turnover individuals, understanding the importance of these bonds is the first step towards securing your financial future.

If you are in the process of appointing an executor, curator, or trustee, it is essential to seek professional advice to ensure that you have the right protections in place. To learn more about how New Heights Finance can assist you with your financial needs, and for a deeper understanding of executor bonds, visit our page on Executor Bonds and Bonds of Security.

Business Loans

The world of business can be vast, and diverse, and a convoluted mish-mash of products, services, and finances all rolled into ever-changing packages and options. It can be overwhelming, and often confusing, to try and gain momentum and grow as a business owner in this kind of climate. From competitive markets to issues of cash flow and expenditure, and the current state of the economy, there are many obstacles and challenges that lie in wait for businesses in South Africa.

It can very quickly begin to feel like a constant uphill battle every time you want to take a step forward as a business. It’s in this current corporate climate that bridging finance has stepped in to assist. Bridging finance refers to the means of getting quick funds in the form of a loan to cover short-term expenses necessary for growth, while you wait for the funds to recoup over a short period of time.

What Is Business Bridging Finance?

Bridging finance for business is the financing of business loans for immediate costs that your business needs to cover. As your business begins to grow, expenses will generally grow at the same time. This can be a tricky situation to navigate for your business because while it may be growing, cash flow can still become a hard line to balance. This is where bridging loans for business are so crucial.

Why Take a Bridging Loan for Your Business?

There are several really good reasons to take out loans for business in South Africa. Business owners can get access to funds immediately by taking out a business loan, which can help facilitate the continued growth and expansion of the business, as well as cover any short-term expenses of the business.

How To Get a Business Bridging Loan for Your Business

Trusted and secure lenders such as business-loan.co.za provide a fast and easy solution to businesses looking to secure bridging loans for immediate use. The application process is simple and to the point, and businesses can get their approved loan in as quickly as one day. If you’re an established and registered business that’s been operating for more than 12 months and have accrued more than R1 million in sales in the last 12 months, then you’re eligible for a business bridging loan. Additionally, you can provide bank statements or issued invoices to verify and substantiate your application for a business loan.

Are You Ready for Your Business Bridging Loan?

Now that you’ve got a good insight into what a business loan can do for your business, the obvious next step is a decision. If you’re in need of immediate funds to propel your business to the next level, a bridging loan might just be what you need. Ask yourself this question; are you ready for your business bridging finance? If the answer is “yes”, don’t hesitate to explore our unsecured business loan and apply now to access business loan funds.

Business Loans

We all know how the old saying goes…when it comes to running a business, cash is king. Steady cash flow ensures your business can cover it’s overheads while continuing to grow. However, many businesses hit a snag when there’s a lag between forking out cash for overheads and receiving money in from customers. This can limit your ability to expand your business.

There are a number of ways to manage cash flow issues and ensure a steady stream of cash entering your business at all times.

1. Cash flow projections

Every business should put together cash flow projections as part of their annual budget. If your business is seasonal and has a few months where there tends to be a lull in business, cash flow projections can help you prepare and plan for dry spells.

2. Get paid sooner

Sometimes the issue is not a lack of sales but payment terms or customers who try stall paying. There are some simple ways you can try get paid faster which include:

- Early settlement discounts (e.g. 5% off when settling in 7 days)

- Take deposits at order placement if lead times are longer

- If customers don’t pay cash up-front, run a credit check before taking them on as a client.

- Put old stock on sale to try get rid of redundant inventory

- Send out invoices promptly and send frequent reminders

- Charge interest on late payments, ensure this clause is in your T’s and C’s.

- If the same customers tend to always pay late, change your terms to cash on delivery for any future dealings with them.

3. Get Smart About Overheads

It’s important to try and get most of your money in BEFORE your expenses are due to be paid out. If suppliers offer 30 day terms, don’t pay on day 15…pay on day 30 once you know most of your income will have hit your account.

If you can, pay your bills using a company credit card. Many offer up to 55 days interest-free which means you’re up to date with your suppliers and you’re not stretched financially. It’s important to stay in their good books. If you ever foresee payment having to be made late, let them know well in advance so they too can manage their cash flow.

4. Unsecured Business Loans

Sometimes even with fine-tuned cash flow projections, chasing payments and carefully managing overheads, businesses still run into cash flow issues. Nobody predicted the Covid-19 pandemic while budgeting last year, for example and despite their best efforts, many business owners find themselves in need of cash, NOW!

The quickest way to get business bridging finance is through an unsecured business loan. You can get access to a cash loan of between R50 000 up to R5 million in as quickly as 1 business day! There’s no easier way to get cash back into your business than by applying for an unsecured business loan with NHFinance. With flexible loan terms and fair interest rates, you can get the cash you need to pay your overheads fast!

5. Direct Debits

Subscription-based businesses or businesses that collect recurring payments often struggle to find ways to collect their payments effectively. One cannot rely on customers making manual payments as they try to skip payments or simply forget to do the EFT. This makes it very hard to manage your cash flow and grow your business as you never know what you’re going to be getting in. It doesn’t have to be this way, however. Businesses accepting recurring payments can sign up for direct debits to automate the process of collecting payments from customers on a set day every month. This eliminates the hassle for the customer and makes your income far more predictable. This solution is perfect for:

- Web hosting providers

- IT services

- Short-term finance companies

- Telecommunications companies

- Gyms

- Subscription-based businesses

- Etc

Business Loans, Personal Loans

With the cost of living in South Africa on the increase, our monthly salary can sometimes barely cover our expenses, never mind during a pandemic where salary cuts and retrenchments are plentiful. From groceries to medical aid, school fees and fuel, expenses add up fast and cash dries up even faster.

If you need cash urgentlyto pay important expenses like electricity, water and rent for example, where do you get it from? Most of us think, I’ll take out a personal loan, so I can get cash today. But the reality is, banks can take weeks or months to get a loan approved. And by then, it’s too late.

And after all that waiting, they could reject your loan applicationbecause you have a bad credit score or no credit history at all. You may think there is no hope to get a loan, but we will show you how to get a loan with no credit check!

Loan Against Movable Assets

If you’ve got valuable jewellery, art, vehicles, boats or other loose assets as security for a loan, you can apply and have cash in your hand in less than 24 hours! We offer a loan product that guarantees you a quick cash loanwhen you lodge your valuables with the lender as loan collateral.

The loan term is very flexible and generally clients choose to pay back the loanover 3 to 6 months, but the loan term can be shorter or longer. This is a very quick way to get a loanwith no risk to you. Your valuables are safely stored away and returned to you in the same condition as soon as your loan is paid up. For more information or to apply for a loan against assets, click here.

For more information on personal loans, property loansor business loans, please take a look around our website. We invite you to apply for any of our loan products should you meet each product’s minimum requirements.

Business Loans

For most business owners, figuring out how to get a business loan in South Africa can be a frustrating process. Many approach their banks directly and still get rejected after a long, drawn-out process, despite showing growth and great future prospects. Sometimes it feels like funding businesses is an impossible task but don’t give up yet, there are ways to secure pollen finance to expand your business!

What Do You Need From Your Business Loan?

Many SMME’s get rejected when applying for business funding because they are applying for the wrong type of loan! First figure out when you need the cash? Do you need it right now or in a few weeks or months down the line? If you’re waiting for a big invoice to be paid you’ll be able to pay back your loan in a matter of days. If you need the cash because your business is seasonal, you’ll need a very different type of loan.

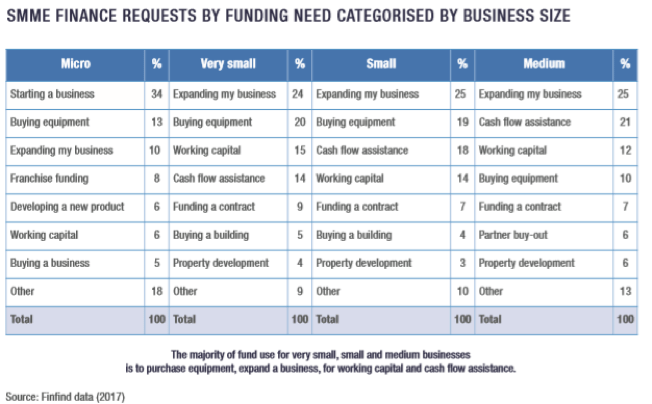

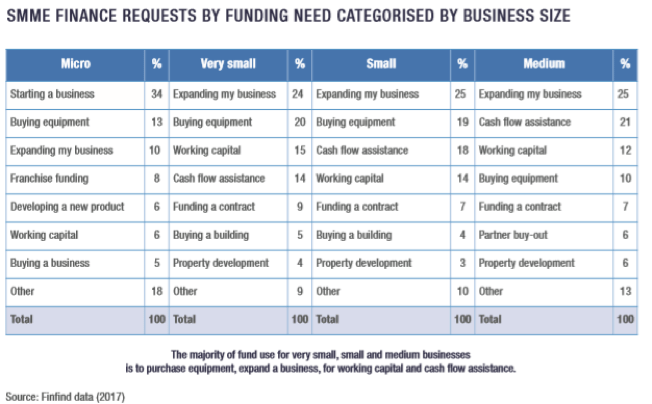

Then ask yourself why you need the cash? What are you using it for? Here is a table with some common SMME expenses that owners seek out loans to cover…

When applying for business finance, make sure the institution you are applying to offer the type of business loan you are looking for.

How To Qualify For A Business Loan

If your business is in good credit, you’ll have a much easier time securing a business loan. If you have a large debtors book, big overheads and unpaid bills, lenders are going to be a lot more nervous loaning your business money.

If you own equipment, machinery, vehicles or your building, these can be considered collateral. They are assets the lender can claim if you default on your business loan repayments.

The longer you’ve been operating and the more financial records you’ve got, the better your chances of getting a business loan approved.

Some lenders have minimum requirements in terms of annual turnover and their various loan products. Check this carefully before applying.

Is It Hard To Get A Business Loan?

Through traditional means, yes! It can feel near impossible! It is easy to get an unsecured business loan with New Heights Finance. We have simplified the process to widen access to business loans for SMME’s.

We offer unsecured business loans to businesses older than 6 months with a turnover of at least R1 million in the last 12 months. Read more about how to get a business loan and we invite you to start the application process with us now.