Business Loans

For most business owners, figuring out how to get a business loan in South Africa can be a frustrating process. Many approach their banks directly and still get rejected after a long, drawn-out process, despite showing growth and great future prospects. Sometimes it feels like funding businesses is an impossible task but don’t give up yet, there are ways to secure pollen finance to expand your business!

What Do You Need From Your Business Loan?

Many SMME’s get rejected when applying for business funding because they are applying for the wrong type of loan! First figure out when you need the cash? Do you need it right now or in a few weeks or months down the line? If you’re waiting for a big invoice to be paid you’ll be able to pay back your loan in a matter of days. If you need the cash because your business is seasonal, you’ll need a very different type of loan.

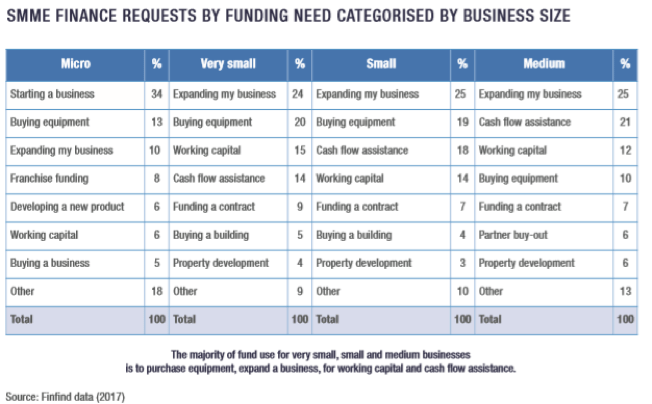

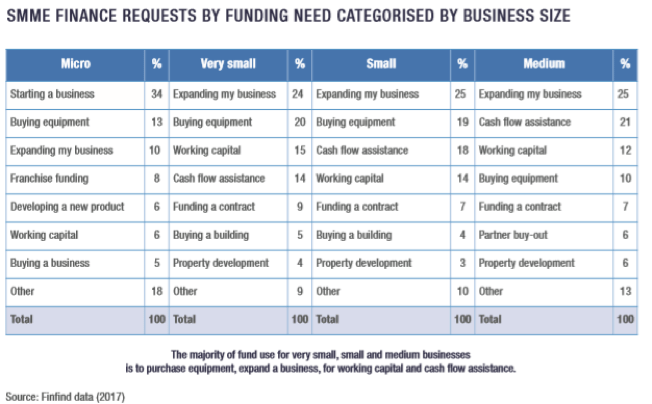

Then ask yourself why you need the cash? What are you using it for? Here is a table with some common SMME expenses that owners seek out loans to cover…

When applying for business finance, make sure the institution you are applying to offer the type of business loan you are looking for.

How To Qualify For A Business Loan

If your business is in good credit, you’ll have a much easier time securing a business loan. If you have a large debtors book, big overheads and unpaid bills, lenders are going to be a lot more nervous loaning your business money.

If you own equipment, machinery, vehicles or your building, these can be considered collateral. They are assets the lender can claim if you default on your business loan repayments.

The longer you’ve been operating and the more financial records you’ve got, the better your chances of getting a business loan approved.

Some lenders have minimum requirements in terms of annual turnover and their various loan products. Check this carefully before applying.

Is It Hard To Get A Business Loan?

Through traditional means, yes! It can feel near impossible! It is easy to get an unsecured business loan with New Heights Finance. We have simplified the process to widen access to business loans for SMME’s.

We offer unsecured business loans to businesses older than 6 months with a turnover of at least R1 million in the last 12 months. Read more about how to get a business loan and we invite you to start the application process with us now.

Property Loans

How do I reduce my monthly bond repayments?

Are your bond repayments too high? Tenants not paying rent? Vacancies increasing? Sounds like you need to

reduce your monthly bond repayments. It is possible to reduce your bond repayments by up to 32% per month and free up cash to get your business cash flow out of the red.

This is how – Interest Only Bonds

Your bond repayment is made up of two main components: capital and interest. The capital amount is the loan amount you took out with your financial institution.

Interest is calculated as a percentage of a loan (or deposit) balance, paid to the lender periodically for the privilege of using their money (The Balance)

So, if you remove the repayment of the capital amount and only pay interest, then it is possible to reduce your

bond repayments by as much as 32%. The reduction in repayments is dependent on the interest rate you are currently paying your bank. The good news is, the interest rate is at an all-time low as a result of the economic turmoil caused by the coronavirus pandemic. Bad for investors, relief for property owners. Back to interest only bonds. The capital amount can be paid back at the end of the loan term.

Here is an typical example (subject to lenders conditions) that outlines the potential cashflow saving:

Traditional Capital and Interest Repayment Model

Bond R 50 million

Term 10 years

Interest Prime plus 1 % ( 11.25 % )

Repayment R 695 844 pm

Interest Only Model

Bond R 50 million

Term 5 years ( plus 5 years if account handled well)

Interest Prime plus 1 % ( 11.25 % )

Repayment R 468 750 pm

This equates to a 32% improvement in cash flow – R 227 094 pm x 12 = R 2 725 128 pa. Capital Repayment – R 50 million at year 5, or rollover if the lenders is happy to refinance.

Types of properties

The ideal types of properties for this financing solution are income-producing commercial, industrial or

residential properties (blocks of flats, hotels, student accommodation), valued at between R 20 million and

R80 million.

If you have a property valued at more then R 80 mill, it is possible to structure the funding in an alternative

manner. The property must have been owned for at least 2 years and have some equity available.

Risks

As a borrower, your risk is reduced because cashflow is improved. With a positive cash-flow you have

funds to buffer your business against any unforeseen circumstances, such as COVID, other natural or

man-made disasters.

How may I use the cash saved?

The cash you will have freed up can be used for other investments or as the property owner requires. The borrower

must, however, remember that at year three to five, the capital has to be paid back. This can come from

the savings made in cashflow, from bank loans, other businesses or even the Interest Only Bond holder,

could refinance or roll-over the loan.

How long does it take to set up the Interest Only Bond?

The lenders need all supporting documents to prepare a submission. The proposal is submitted to the credit committee for assessment. If all in order, then a valuation of the property is done and the final term sheet is presented to you. This normally takes 2 to 3 weeks, measured from when ALL the requested supporting documents have been received.

What are the costs?

The interest rates charged are market related. Rates from prime plus 1% to prime plus 3% are available. This is risk dependent. The current bond on the property would need to be cancelled and a new bond registered. There may be bond cancellation costs and there will be bond registration costs. There are also the normal administration and raising-fee costs.

- Main Advantages

Companies wanting to grow their property portfolios can use this finance facility to purchase more

property.

- If there is equity in the property, it is possible to release this equity.

- Cash-flow is improved. Reduction in monthly payments of up to 32 % are possible.

- Reduced interest rates. Some property owners are paying rates in excess of prime plus 5 %. There are

savings to be made using these commercial bond facilities.

For more information visit https://nhfinance.co.za/interest-only-bonds/

Pension Loans

Retirement, Dismissal, Resignation, Death or Divorce are traumatic events in a working persons life, but on the positive side, the lucky ones who have had a company pension or provident savings scheme, are able to make their policy paid up and they can draw down a portion of their funds.

That is the good news. The bad news is that it can take months to get the pension funds from the pension administrators. The reasons for these delays are varied and very frustrating for the individual. In most cases

large corporate companies with call-centres that have very little incentive to process claims fast. This leaves the ex-employee, perhaps only drawing minimum benefit from UIF and now unable to meet their financial obligations.

The Solution

Private pension lenders have recognized this problem and are able to advance pension cash to persons that have given notice to their pension fund, that they require their money to be paid out.

These Pension Bridging companies give pension loans from as little as R3000 up to R50 000 and even more in some circumstances. These funds are made available within 48 Hours of all the paperwork being completed. Yes, you hear right – 48 hours to get your pension payout!

Repayment

Once the provident or pension fund pays out the investment funds, the provident loan or pension loan plus interest and fees is paid back to the lender and the balance is paid to the fund member.

Cost

Provident Bridging loans and Pension Bridging loans, landing rates are governed by the NCA (National Credit Act). Private lending companies are obliged to comply with the NCA or risk having their licences withdrawn. Rates charged for these provident loans are fair considering the risk the lender takes.

Security

Pension bridging does not require any type of security. It is essentially an unsecured personal loan.

Risk

There is no risk to the borrower. There is a cost because the pension lender or provident lender charges interest and an administration fee. The borrower does not have worry about their pension money being stolen. The reason that the risk is low, is that the pension and provident money is paid directly into the members bank account, not to the lender.

Credit Bureau Listing

People often ask if they can get a pension loan if they have a poor credit profile. The good news is,

yes they can. This financial solution is designed to assist those in financial difficulty.

Provident Fund Loans and Pension Loans are a useful way for people that have funds saved to access some of their savings to assist them during difficult financial times.

Business Loans

Is your business taking strain under our extended lockdown? Bills mounting up, COVID 19 UIF not paying out, creditors calling for their money and clients not paying? Does that sound familiar? Rest assured, there is help at hand. A new business funding mechanism is available to businesses that have been operating for longer than 12 months and have a good credit record. These are called Unsecured Business Loans.

Requirements for An Unsecured Business Loan

- All that you need to provide is 6 months bank statements for the initial assessment. No need for audited financial statements, debts and creditors profiles, assets registers and other complicated documents. You’ve got enough on your plate already, we try to make the loan application process one less thing to stress about.

- Private Lenders

These Business Funds are offer by private lenders. These companies are easy to deal with and

respond quick because they are keen to lend money to business. The reason for this is that they

make money when they lend money. While the money is in their bank accounts it is not making

them money, therefore they are eager to assist you with your business loan requirements.

- Loan Sizes

The minimum loan amount is R50 000 and the maximum R1,5 Million. The amount a company

is legible for is dependent on the company turnover and how regularly the income comes into

the business.

- Timeframe

Due to the simple and streamlined process the loan approval can be within 3 days, but approval time is always subject to the applicant providing the information the lender needs timorously.

- Repayment

Repayment of business finance loans like these are made over a 6 month term. The repayment

is calculated by adding the loan plus interest together and then divided by 26 weeks. Repayment is by weekly debit order for a period of 26 weeks.

- Refinance

If a borrower has repaid the unsecured business loan on time for 13 weeks, then they are entitled to apply for a further business cash advance. The lender will reassess the business and make a decision on whether to advance further business funding.

Typical Applicant Profile

The lenders want to advance cash to businesses that have strong and regular cash flow. Businesses with daily or weekly cash in-flows are good candidates for a business loan approval. Typical strong, regular cash flow businesses are Filling Stations, Supermarkets, Butcheries and Hairdressers.

No Security Necessary!

A big advantage of unsecured business loans is that the borrower does not have to provide any security. Banks and other secured lenders want property, debtors and even plant and equipment as security for their loans. But in our harsh economic circumstances this model is not always possible which is where unsecured business loans come in to assist you to improve cash flow in your business right away.

Default on Loan

As with any type of lending, if the borrower defaults on the repayment, the lender is entitled to take legal action to recover their money. This can lead to the company and its members being listed at the credit bureaus and this has a negative effect on any business. It is best to not borrow money, if there is a likelihood of not being able to pay the loan back.

Unsecured business loans are suitable for businesses that have positive and regular cash flow. They are not the cheapest form of business loan but they are quick (1 days to approval), no security is needed and they suit businesses that are in need of a Short Term Bridging loan.

Personal Finance

When we rang in the New Year, who would have guessed we would face a global pandemic that would creep into every country and continent across the world. That some of us would lose businesses, lose our jobs or take massive salary cuts. We are living in extraordinarily difficult times.

The business gurus and commentators say there is a new ‘normal’ we all need to get used to which includes working from home, working in shifts or teams and often as a result, reduced hours. Unfortunately, this new way of doing business has resulted in company retrenchments, dismissals and forced resignations across almost every industry, with some being harder hit than others. As of today, hair & beauty salons, restaurants, certain manufacturing concerns and gyms to name a few can only operate under reduced capacity and with major restrictions in place. Many businesses have been unable to bring in an income since lockdown in South Africa started on 26 March 2020.

When faced with this situation, UIF registered employees can claim from the Unemployment Insurance Fund. The problem with UIF is that it does not pay out the full wage or salary. This leaves an income shortfall. Families expenses are generally fixed and there is very little opportunity to reduce monthly living costs. For example: school fees, rent, bond repayments and food are all fixed costs.

The good news is that there are a number of temporary financial solutions available to the public:

1. Pension Loan

If you have given notice to your pension fund or provident fund that you want to make your policy paid up, it is possible to secure a short- term Pension Bridging Loan from accredited private lenders.

2. Property Secured Loan

If your home is bond-free or has a bond that is less than 40% of the property value, it is possible

to secure a Loan Against the Property in some circumstances, to help you free up cash to cover expenses.

3. Loan Against a Movable Asset

It is possible to use your valuables like gold, diamonds, art, antiques, jet skis, cars, bakkies, motorbikes and other loose assets, as security for a loan.

When faced with the daunting prospect of retrenchment, do not panic. There are temporary financial solutions that enable families to make it through the tough times. For more ideas and financing solutions click here: www.nhfinance.co.za