Personal Finance

South Africans have always experienced tougher economic conditions than other countries so its no wonder we are savvy when it comes to saving money. With economic conditions being tougher than ever before, many South Africans are cutting back on their expenses in order to save money and make it through the month. In fact, 55% of all households are still bearing the brunt of the strain the Cover-19 pandemic have put on their finances.

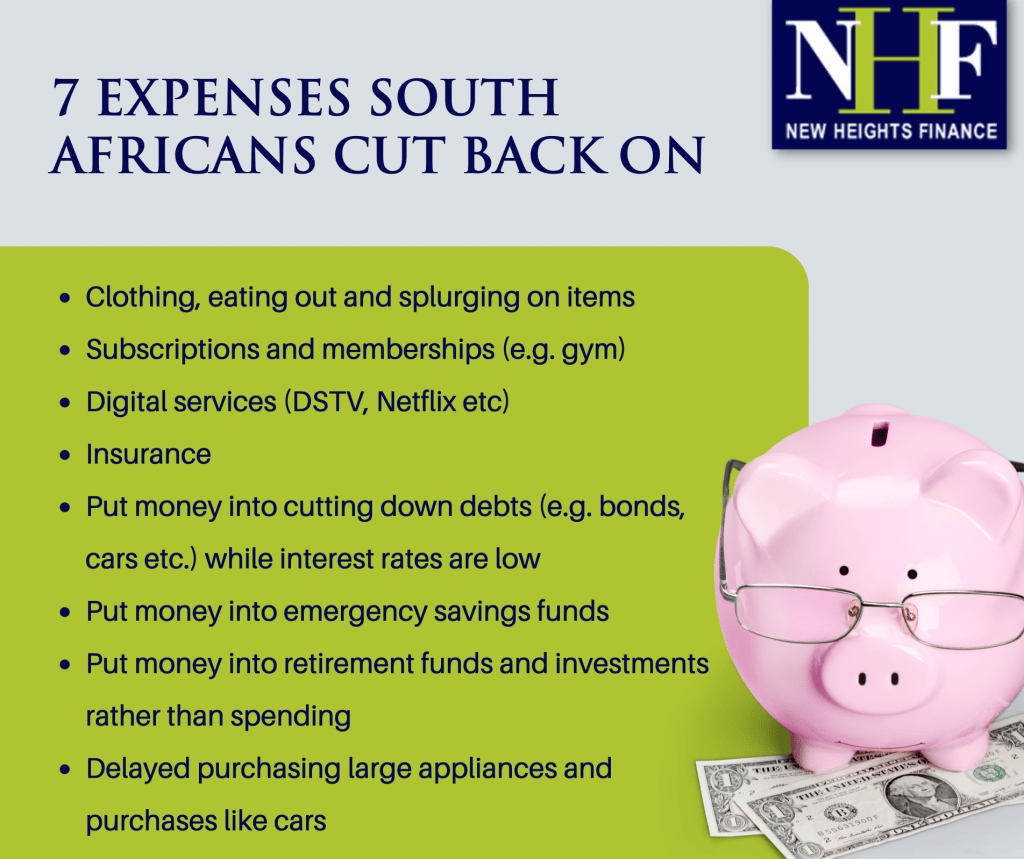

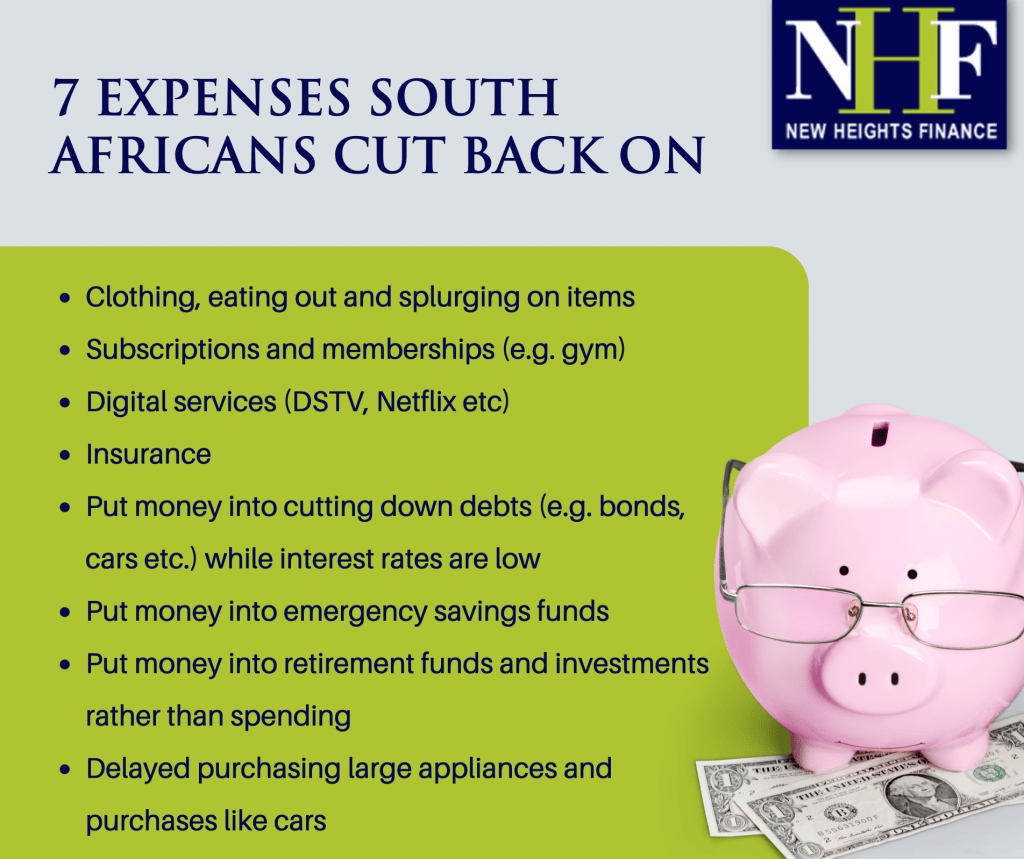

Here is a list of the top expenses South Africans cut back on in 2023:

Most consumers have cut back on luxury and big-ticket purchases like appliances, cars and luxury brands, delaying the purchases until their personal finances recover. They have also cut back on subscriptions and memberships like gym and mobile phone contracts.

On the flip side, households have put more money into emergency savings funds, into cutting down debt and into retirement funds. 85% of households are very concerned about how they will manage to pay their bills and debts going forward if things don’t improve.

If you find yourself in a real financial bind and need access to cash quickly, apply for one of our loan solutions today:

Personal Loans – got a clear credit record and need up to R150k fast? Apply for a personal loan.

Pension Bridging Loans – waiting for your pension or provident payout? Apply for a pension cash advance and get some of your money early to ease financial stress.

Loans Against Assets – use art, jewellery, handbags and luxury items as security for a secured personal loan. Get them back once your loan is paid up.

Loans Using Un-bonded Property – is your property valued at over R2 million and fully paid up? Use your home as security for an equity release loan of R1 million or more.

Personal Finance

When we rang in the New Year, who would have guessed we would face a global pandemic that would creep into every country and continent across the world. That some of us would lose businesses, lose our jobs or take massive salary cuts. We are living in extraordinarily difficult times.

The business gurus and commentators say there is a new ‘normal’ we all need to get used to which includes working from home, working in shifts or teams and often as a result, reduced hours. Unfortunately, this new way of doing business has resulted in company retrenchments, dismissals and forced resignations across almost every industry, with some being harder hit than others. As of today, hair & beauty salons, restaurants, certain manufacturing concerns and gyms to name a few can only operate under reduced capacity and with major restrictions in place. Many businesses have been unable to bring in an income since lockdown in South Africa started on 26 March 2020.

When faced with this situation, UIF registered employees can claim from the Unemployment Insurance Fund. The problem with UIF is that it does not pay out the full wage or salary. This leaves an income shortfall. Families expenses are generally fixed and there is very little opportunity to reduce monthly living costs. For example: school fees, rent, bond repayments and food are all fixed costs.

The good news is that there are a number of temporary financial solutions available to the public:

1. Pension Loan

If you have given notice to your pension fund or provident fund that you want to make your policy paid up, it is possible to secure a short- term Pension Bridging Loan from accredited private lenders.

2. Property Secured Loan

If your home is bond-free or has a bond that is less than 40% of the property value, it is possible

to secure a Loan Against the Property in some circumstances, to help you free up cash to cover expenses.

3. Loan Against a Movable Asset

It is possible to use your valuables like gold, diamonds, art, antiques, jet skis, cars, bakkies, motorbikes and other loose assets, as security for a loan.

When faced with the daunting prospect of retrenchment, do not panic. There are temporary financial solutions that enable families to make it through the tough times. For more ideas and financing solutions click here: www.nhfinance.co.za